Selected RegEnergy Fund

An investment fund with an exceptional expected annual return (IRR) of +15% based on sustainable recycling projects in Scandinavia. The minimum investment is EUR 100,000.

+15%

Expected annual return (IRR)

Recycling

Recycling waste heat for local food production in Scandinavia

Sustainable

A green fund screened under the EU's taxonomy regulation

10 years

Investment period for the project

100,000

Minimum investment in EUR

Registration at

Gibraltar Financial Service Commission

Sustainable recycling projects in Scandinavia

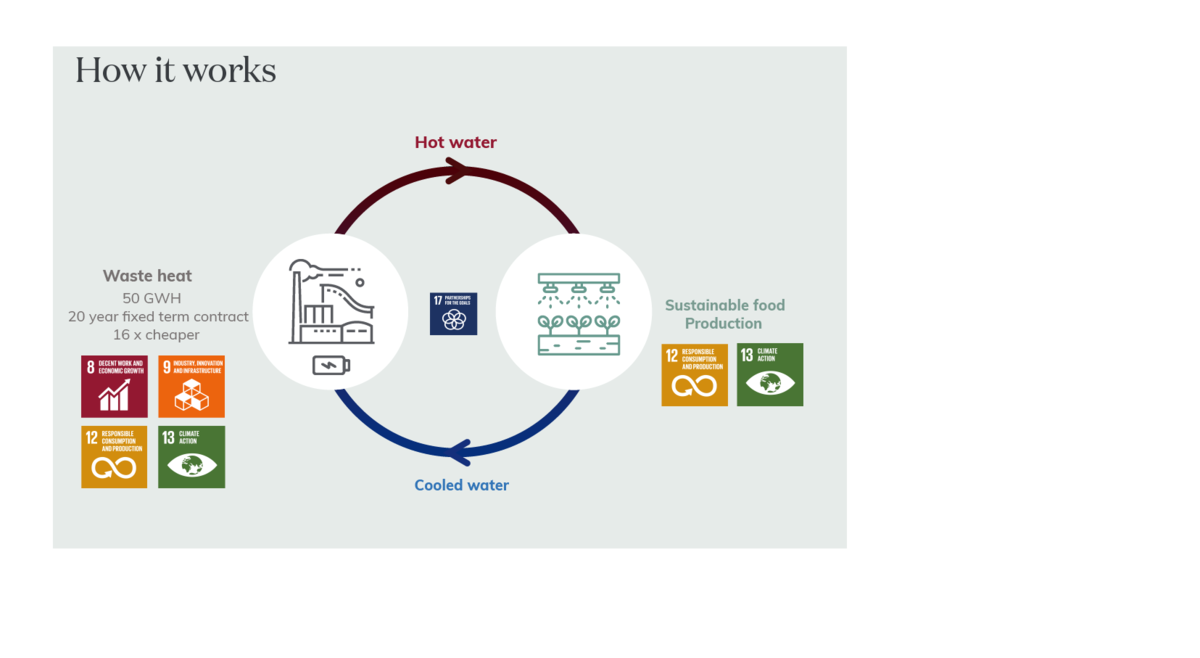

Selected RegEnergy is an investment in a pioneering recycling concept based on the recovery of waste heat from large industrial companies in Scandinavia, which is used for sustainable local food production.

As an investor in Selected RegEnergy, you will receive an exceptional expected annual return (IRR) of +15% p.a., while the fund has a highly sustainable profile that meets several of the UN's Sustainable Development Goals.

A significant part of the value creation comes from a circular approach, where one company's waste product becomes a valuable input in another production. For example, in one of the fund's first projects, waste heat from a Swedish paper products factory is used to heat tomato production greenhouses.

The budgeted annual return (IRR) over the 10-year investment period is +15% and the project has a minimum investment of EUR 100,000.

The access to abundant and affordable heat for the Fund's first two investment projects, Frövi, is secured through a twenty-year contract with the Swedish paper products company, Billerud, which has major production facilities in Frövi, Sweden. The contract ensures an annual heat supply of up to 50 GWh p.a. to the project.

The heat has been bought at a very low price, as it has only been in surplus so far. So far, the paper company has used a local river to cool the water from production, and the heat from this has not been used for anything. The availability of surplus heat provides a competitive advantage for project operators and helps ensuring high expected returns for investors.

CIRCULAR ECONOMY

Based on sustainable food production using heat from one of the largest paper product producers in the Nordic region, located a few hundred metres from the project site.

POLITICAL GOODWILL

All necessary building permits have been obtained and there is a lot of political goodwill towards the project because of the many new jobs and the desire to increase the share of locally produced food in Sweden.

EXPERTISE

The project is being established in collaboration with some of the world's leading experts in heat recovery and control for industrial use. These have extensive experience from previous projects.

RELIABILITY

Day-to-day operations are secured with long-term contracts from leading food producers, who themselves bear large initial set-up costs and thus have significant incentives to remain associated as long-term operators.

IMPACT

Access to 50 GWh of waste heat each year creates a major competitive advantage compared to imported food and ensures a positive contribution to the global climate balance.

LOCAL

The food is sold locally in Sweden, where there is a strong and growing demand for fresh food produced locally and with minimal use of pesticides.

Latest News - RegEnergy

Development in the RegEnergy Fund

There are ongoing developments in the RegEnergy project, which you can follow on this page. Read the latest news from the Fund here.

Learn more about the project

Risk

The risk of the Fund's first projects is primarily related to the typical risks of developing infrastructure projects, the expected value of the projects upon sale, and securing the right partners. In addition to these risk factors, there are also risks associated with possible fluctuations in the selling price of the output.

The development of energy infrastructure is a lengthy and complex process, where unforeseen events and delays in projects can occur. Being a development project, there could be unexpected delays, and price increases for construction materials. However, the Fund's senior management has extensive experience in this type of project, which reduces the risk of delays and higher costs, although these may have an impact on the Fund's profitability.

The high expected return of this fund reflects the fact that its projects are not yet operational and that investors therefore assume a risk during the development and construction phase. However, this risk is mitigated by a fully comprehensive construction contract where the vast majority of construction costs are contractually fixed.

The valuation of assets on exit on sale is also a natural risk for investors. The Fund has budgeted for the resale of projects once they are operational and have reached their full development potential. This may happen after only 5 years, but a 10-year investment horizon is budgeted.

A minor partner risk exists in relation to the Billerud, which supplies the waste heat for production on a 20-year fixed contract at a fixed agreed price. However, the company's size and competitive strength are so significant that this risk is quite modest.

Key investor information

Key Investor Information is a document called PRIIP KID.

The term PRIIP covers composite insurance and investment products for retail customers. For this type of product, it is required that a document containing basic information about the product is compiled.

The document is referred to as KID which is short for Key Information Document. It is similar to the Central Investor Information, which aims to help investors understand how an investment product works and allow a product to be compared to other similar investment products. However, the KID provides a little more detail and information as products are typically more complex.

If you invest in Selected RegEnergy, it is required that we are able to show and/or provide you with such a document.

It will be a natural part of our information to you during an advisory meeting that we show it to you and review it with you.

You can find our key investor information document here:

Dokument med central information (KIID) Selected Regenergy 20230120 (Danish)

If you are investing via VSO, you can find the Key Investor Information document here:

Dokument med central information (KIID) Selected Regenergy 20230120 (Danish)