Selected Alternatives Fund

Get access to a unique and broad investment portfolio of alternative investments such as solar, wind, green infrastructure and real estate based in Scandinavia. The fundt offers stable returns and low correlation to the stock market. The minimum investment is EUR 100,000.

6-8%

Expected annual return (IRR)

Registration at

Gibraltar Financial Service Commission

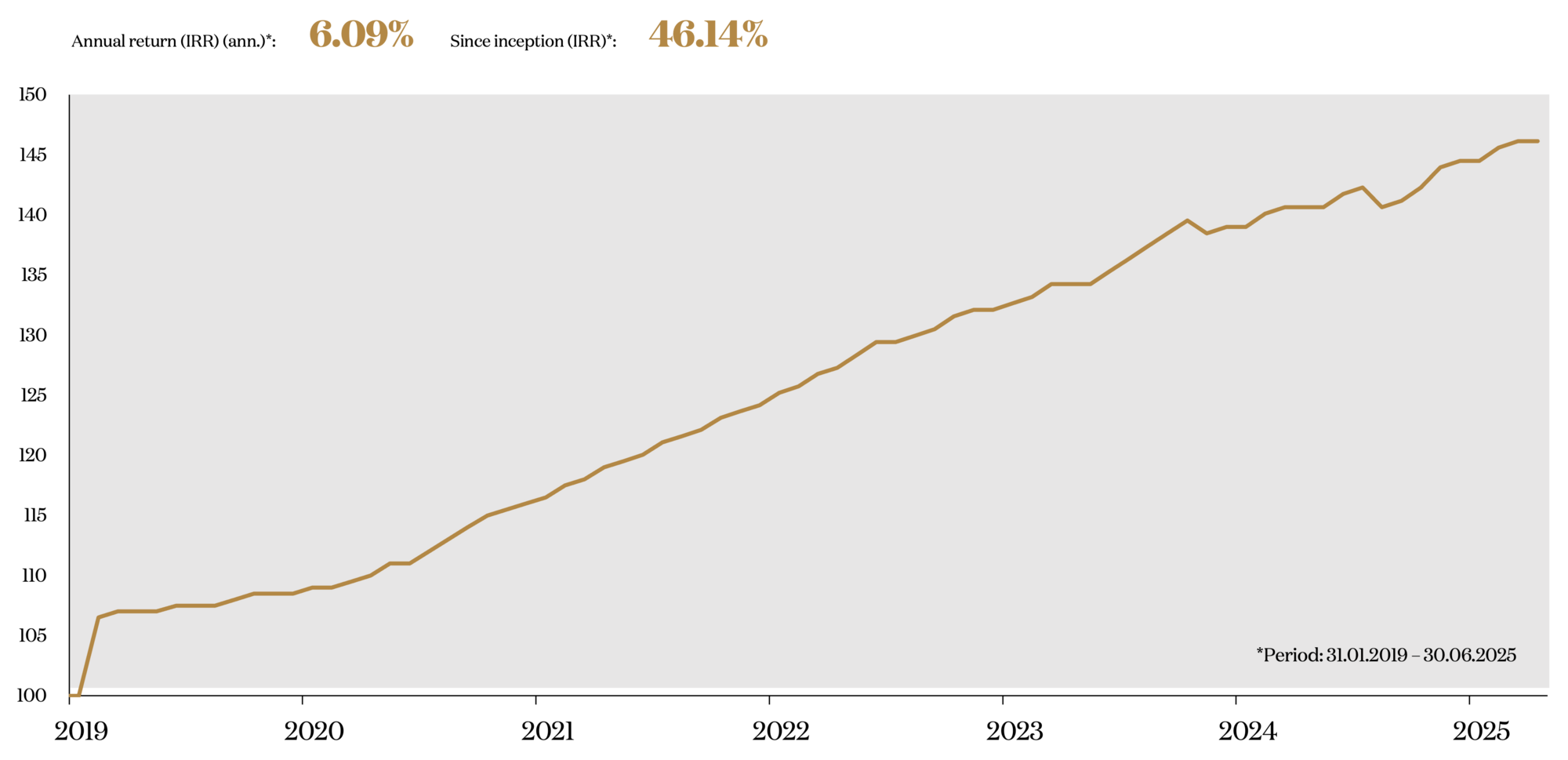

6.09%

Historic annual returns (IRR) since the fund's launch in 2019

100,000

Minimum investment in EUR

A fund with alternative assets based in Scandinavia

Selected Alternatives fund is an investment in a fund with a broad portfolio of alternative investments spread across real estate, solar, wind and green infrastructure based in Scandinavia, which are usually reserved for institutional investors.

As an investor in the Selected Alternatives fund, you will receive a stable expected return with regular dividends and a low correlation to the stock market. You also get a high degree of diversification through the fund's different types of investments, which adds stability to any investment portfolio.

The Fund invests in operating alternatives that generate ongoing profits and dividends for investors. The investments often have a green profile such as Power-to-X and green energy projects, which therefore contribute to the green transition.

The Selected Alternatives fund provides an expected annual return (IRR) of 6-8% and since its launch in 2019, the fund has provided investors with an average annual return (IRR) of 6.09%. The minimum investment is EUR 100,000.

An investment community

The Selected Alternatives fund was created to provide private investors with the same opportunities as institutional investors to risk-adjust their returns through alternative investments. We call it an investment community because the fund pools money from private investors and invests it in alternative investment projects.

As the investors' money in the Selected Alternatives fund is pooled into one broad portfolio, the fund can invest EUR 10 - 30 million at a time in individual projects. Therefore, the fund and its investors also qualify for the same unique projects and attractive terms as, for example, pension funds.

Latest news - Selected Alternatives Fund

Development in the Selected Alternatives Fund

There are ongoing developments in the portfolio of the Selected Alternatives fund, including when the fund invests in new alternative assets or divests from current investments. Read the latest news from the fund here.

Learn more about the project

Risk

All investments involve a certain degree of risk. The principal risk factors associated with an investment in Selected Alternatives A/S include:

- Market risk in relation to the value of the underlying assets

- Risk associated with the profitability of the projects

- Risk associated with the production facilities

- Interest rate risk

- Political risk

- Credit risk

- Liquidity risk

- Currency risk

Key investor information

Key Investor Information is a document called PRIIP KID.

The term PRIIP covers composite insurance and investment products for retail customers. For this type of product, it is required that a document containing basic information about the product is compiled.

The document is referred to as KID which is short for Key Information Document. It is similar to the Central Investor Information, which aims to help investors understand how an investment product works and allow a product to be compared to other similar investment products. However, the KID provides a little more detail and information as products are typically more complex.

If you invest in Selected RegEnergy, it is required that we are able to show and/or provide you with such a document.

It will be a natural part of our information to you during an advisory meeting that we show it to you and review it with you.

You can find our key investor information document here:

Dokument med central information (KIID) Selected Alternatives 20230123 (Danish)